How to Teach Your Kids Financial Literacy in Nigeria

Financial literacy is an essential skill that everyone should learn, and the earlier we teach our kids, the better. In Nigeria, where economic challenges like inflation and rising costs of living are common, it is even more important to equip the next generation with the knowledge and skills to manage their finances effectively.

Teaching kids about money can be a fun, rewarding, and valuable experience. It not only sets them up for success in life but also promotes responsible habits that last into adulthood.

In this article, we’ll explore how to teach your kids financial literacy in Nigeria through age-appropriate lessons on saving, budgeting, and investing.

Whether you have toddlers, school-age children, or teenagers, there are practical steps and strategies that you can implement to build their financial knowledge and empower them to make smart financial decisions.

Why Financial Literacy is Important for Kids in Nigeria

Before diving into the “how,” it’s important to understand why financial literacy matters. Financial education helps children develop good habits like saving for the future, budgeting their allowances, and even understanding the value of money.

In Nigeria, these lessons are particularly crucial, as the country has faced economic fluctuations, high inflation rates, and changing job markets. Kids who understand money early on can make informed decisions, avoid falling into debt traps, and gain the confidence to handle their finances responsibly as adults.

Step 1: Start Early – Teaching Toddlers about Money

When it comes to teaching your kids about money, the earlier you start, the better. Even toddlers can begin to understand basic money concepts, such as recognizing coins and bills, identifying the differences between items that cost more or less, and grasping the idea of “buying” and “selling.”

These early lessons lay the foundation for more complex financial knowledge as they grow older.

Money as a Concept

At this age, teaching your child that money is used to buy things can be achieved through play. Consider giving your toddler a toy cash register and pretend money to simulate buying and selling.

This will help them develop the idea that money has value and can be exchanged for goods or services. You can also show them how to save coins in a piggy bank, explaining that the more they save, the more they can buy in the future.

Encourage Good Habits

Introduce simple ideas like saving by encouraging your child to place some of their “earnings” into a piggy bank or jar. Explain to them that if they save a little each day, they will eventually have enough to buy something they want.

This lesson in delayed gratification is important, as it teaches the value of saving over spending immediately.

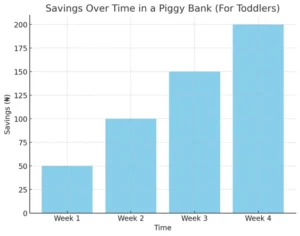

Below is a simple bar chart illustrating how coins add up over time. You can use this chart as a practical and engaging way to pass the message of savings to young toddlers.

Bar Char showing the progression of savings over time

Bar Char showing the progression of savings over timeStep 2: Introduce Saving and Budgeting – For Kids Aged 6 to 12

As your child grows, you can start introducing more structured concepts like saving and budgeting. By age 6, children can begin understanding the importance of managing their money and making decisions about how much to save, spend, or share.

Saving Money

At this stage, teaching kids how to save is essential. You can introduce the concept of setting goals for what they want to purchase. For example, if your child wants a new toy or game, help them break down how much money they need to save weekly to reach that goal.

You can even set up separate jars or envelopes for “spending,” “saving,” and “giving.” This teaches them how to divide their money into categories, and it helps them understand that they can’t spend everything at once.

Budgeting Basics

Budgeting is a vital skill that can be taught through practical exercises. You can help your child make a simple budget by setting up a “money allowance” and then deciding how much to spend, save, and donate.

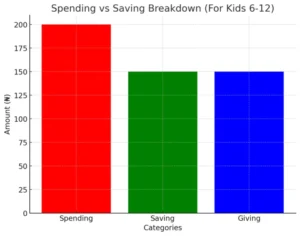

For instance, if your child gets ₦500 weekly as an allowance, you can break it down like this:

- ₦200 for Spending: Buying snacks or a toy

- ₦150 for Saving: Putting in the piggy bank for future purchases

- ₦150 for Giving: Donating to a cause or helping a family member

This teaches your child how to make decisions about their spending while understanding that some of their money should be saved for later use or given to others.

Fun Games and Activities

You can use fun games like Monopoly or board games involving money to engage your child in learning about budgeting. These games allow kids to practice making money decisions, such as buying property or paying rent.

There are also many online resources and apps available in Nigeria that are specifically designed to teach kids financial literacy through interactive games and activities.

Chart Illustrating Spending vs. Saving

Chart Illustrating Spending vs. SavingStep 3: Teach the Importance of Investing – For Teenagers (Ages 13+)

As your child enters their teenage years, it’s the perfect time to introduce the concept of investing. Teenagers are more likely to grasp complex financial topics, and learning about investing can empower them to make better financial decisions as they approach adulthood.

What is Investing?

Explaining investing to teenagers can be tricky, but with the right approach, they’ll understand the basics. Start by explaining that investing means using money to buy something that will hopefully grow in value over time.

For example, you can talk about how people invest in stocks, real estate, or businesses to build wealth. You can use real-life examples, like the growth of companies such as Dangote Cement or MTN, which they are likely familiar with.

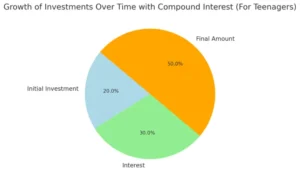

The Power of Compound Interest

One of the best lessons in investing is teaching your teenager about compound interest. Explain that the more they invest, the more their money can grow over time. You can use an example of putting money into a savings account that earns interest or investing in stocks that increase in value.

If they start investing at a young age, they will benefit from years of compound growth, which is why it’s crucial to begin early.

Practical Investing Lessons

Introduce your teenager to the world of stocks and bonds through a beginner-friendly platform like the Nigerian Stock Exchange (NSE). Many Nigerian banks and financial institutions offer youth-oriented investment accounts.

You can help your teenager open a simple account and begin small with investment options such as mutual funds or government bonds.

Understanding Risk and Diversification

Teach your teen about the concept of risk and diversification. Not all investments are the same, and it’s important to spread out their investments to reduce the risk of losing money.

Show them how diversifying their portfolio by investing in different assets (stocks, bonds, real estate, etc.) can reduce the likelihood of significant losses.

Pie Chart showing the Growth of Investment over Time

Pie Chart showing the Growth of Investment over TimeStep 4: Encourage Financial Independence and Responsibility

As your child progresses into their teenage years, it’s essential to encourage financial independence. This means letting them take control of their money and make their own financial decisions.

You can give them responsibilities, such as managing their school fees, saving for a trip, or budgeting for clothing. It’s important that your kids feel confident in managing their finances and understand the consequences of poor financial choices.

Conclusion

Teaching your kids about financial literacy in Nigeria is one of the best gifts you can give them. By starting early, you can help them develop a solid understanding of saving, budgeting, and investing, which will serve them well throughout their lives.

These skills will not only help them manage their finances effectively but also give them the confidence to make smart financial decisions as they grow older.

Whether you’re using simple activities for toddlers or providing more complex lessons on investing for teenagers, each step you take toward teaching financial literacy contributes to your child’s long-term success.

In a country like Nigeria, where financial stability can be a challenge for many, these lessons are invaluable in preparing your kids for a future of financial independence and security.